KUCHING June 4. This is because the tax invoice not only enables the seller to collect payments but also avail input tax credit under GST regime.

Malaysia Sst Sales And Service Tax A Complete Guide

John subtracts his GST credit from the purchase price 1100 - 100 GST 1000 and uses 1000 to calculate the deduction he is entitled to in his tax return.

. You can file the GST Invoices for returns through GST portal and claim input tax credit on your business purchases. The manufacturer had paid INR 118 towards GST during the purchase of his input raw materials. Isham said having GST in place would help.

The GST law makes it necessary for registered taxpayers to issue invoices for the sale of goods or services. If you supply or receive an invoice that only has a figure at a wine equalisation tax-goods services tax WEG label you need further information to claim GST credits and for it to be considered a valid tax invoice. KUALA LUMPUR June 10 The Goods and Services Tax GST will be improved in terms of the efficiency of its reimbursement process business compliance level as well as overall administration if the government decides to reintroduce the tax.

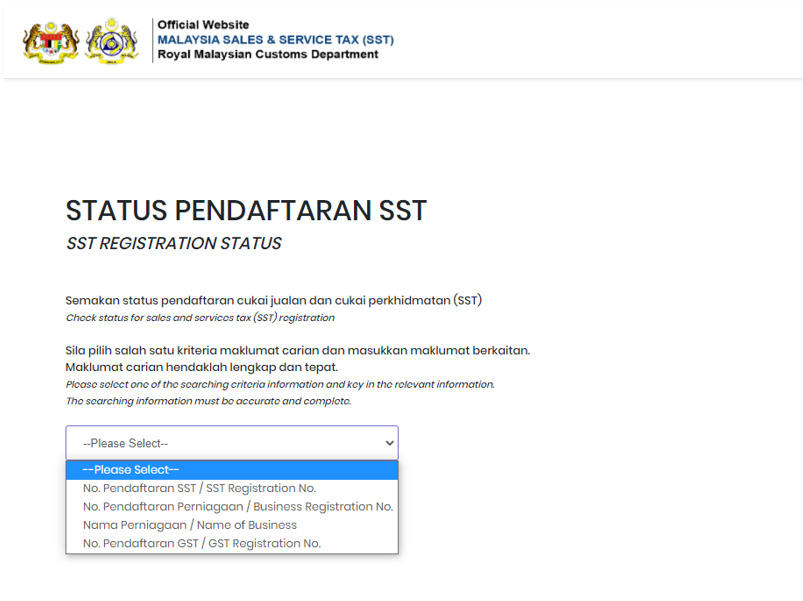

Sales and Service Tax SST in Malaysia. The Ministry of Finance MoF announced that Sales and Service Tax SST which administered by the Royal Malaysian Customs Department RMCD will come into effect in Malaysia on 1 September 2018. Now the tax on it will be INR 144.

Tax invoices sets out the information requirements for a tax invoice in more detail. These depend on various. Finance Minister Datuk Seri Tengku Zafrul Abdul Aziz said.

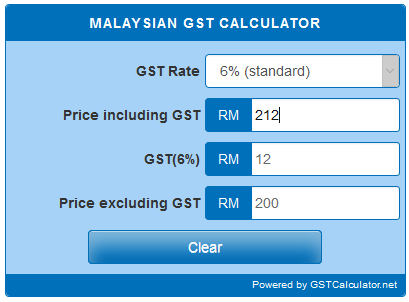

Calculating the amount that needs to be paid as GST when filing your returns can be quite tedious. So the manufacturer will invoice the pressure cooker for INR 944. GSTR 20131 Goods and services tax.

At least 11 gazetted public holidays inclusive of five compulsory public holidays. Depending on the type of the insurance you may opt to pay the premium on a monthly or yearly basis. When you have a sales and services tax SST the wealthy can avoid paying taxes he said.

John can claim a GST credit of 100 on his activity statement. Failure to pay the entire GST amount can see you slapped with an 18 interest on the shortfall thereby making it necessary to ensure that you. At the end of the term.

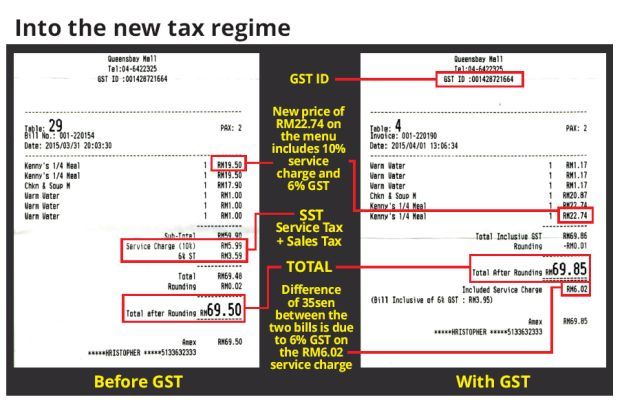

Unlike the GST the sales and services tax SST system enabled tax evasion as it entrusted only one stage of the supply chain to charge the tax and pay it to the authorities. This is particularly concerning following a pandemic that has disproportionately impacted poor and vulnerable Malaysian households as well as increases in food prices. Now there are different types of invoices that are issued under the GST law.

How do I calculate GST. What benefits do I get if I update my GST number with Amazon. Assume that the steel utensil attracts a GST of 18.

ACCCIS secretary-general Datuk. By updating your GST number with Amazon as a Business customer you can explore lakhs of products with GST Invoices offered by Business sellers. Taxable and non-taxable sales.

Hence the manufacturer is collecting INR 144 as GST on sale from the distributor. Remember to pay your insurance premium. The Associated Chinese Chambers of Commerce and Industry of Sarawak ACCCIS is all for the reintroduction of the Goods and Services Tax GST.

John can also claim an amount that reflects the decline in value of the photocopier on his tax return. Not exceeding eight hours in one day or 48 hours in one week. Several aspects and factors must be taken into consideration such as ITC exempted supplies reverse charge etc.

The move of scrapping the 6 GST has paved the way for the re-introduction of SST 20 which will come. The amount of the premium is determined on the risk and the value of what youre insuring against at the time and may be subject to changes eg. National Day Birthday of the Yang Dipertuan Agong Birthday of RulerFederal Territory Day Labour Day and Malaysia day in one calendar year and on any day declared as a.

As a consumption tax GST taxes a flat rate where the poor and low- and middle-income groups pay a higher proportion of their income on GST compared to the higher income groups.

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Malaysia Sst Sales And Service Tax A Complete Guide

No Gst Price Remains Good News All Leagoo Malaysia Absorp Gst Charge For Models Stated Below Lead 2s Rm499 Lead 7 Cal Logo School Logos Logos

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

An Introduction To Malaysian Gst Asean Business News

What Is Service Charge Do I Have To Pay It

Check Out Our Ad In Loksatta Presenting Monsoon Magic Offer Limited Period Advantage Pay 0 Gst Book Today Save Upto Rs 3 Ambernath Eco Luxury Real Estate

Welcome To Biztory Cloud Accounting Software Malaysia Online Web Based Small Business Gst Compl Accounting Software Invoicing Software Cloud Accounting

Online Gst Accounting Software Made Easy Affordable For Smes Accounting Software Accounting Tax Services

Welcome To Biztory Cloud Accounting Software Malaysia Online Web Based Small Business Gst Compliant Cloud Accounting Accounting Software Accounting

Loan Interest Rates Flat Rates Vs Fixed Rates Vs Variable Rates Loan Interest Rates Personal Loans Bugeting

Gst Rates In Malaysia Explained Wise

Malaysian Gst Calculator Gstcalculator Net

6 Feb 2016 Onward Dunkin Donuts Chinese New Year Promotion Dunkin Donuts Dunkin Donuts

9 31 May 2015 Kfc Super Jimat Box Promotion Kfc Super Food

Malindo Air Magnificent May 50 000 Free Seats In Malaysia Magnificent Free Free Flights

Advantages And Disadvantages Of Gst In Malaysia Financial Aid For College Tax Software Mortgage Interest

Sale And Purchase Agreement Malaysia Sample Ten Great Lessons You Can Learn From Sale And Pu Purchase Agreement Lesson Agreement

Be Central Be Rewarded New Year Menu Year Of The Monkey Function Room